Performance

Another quarter has passed and it's time to take stock of portfolio's performance.

Another quarter has passed and it's time to take stock of portfolio's performance.

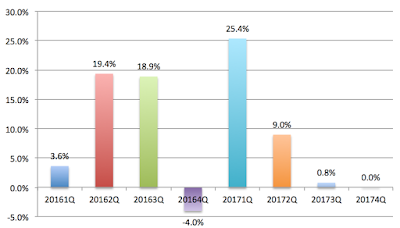

It is a muted performance for the quarter, resulting in a slight increase in NAV compared to 20171H performance. In fact, if not for the strong performance of Valuetronics and UMS over the past few days, this quarter will post a return lower than 20171H.

NAV of portfolio grew from $3.78 (30 Dec 2016) to $5.22 (30 Sep 2017), providing a return of 37.8% for 9 months. Definitely happy as this is well above my stretched target of 12% and also beats benchmark STI ETF which returned about 14% (inclusive of dividend) over the same period.

The muted quarter's performance can be attributed to the following:

- weaker market sentiment for the past quarter,

- continued sell-down of Raffles Medical Group,

- correction of Food Empire,

- divestment of Micro-Mechanics which shot up 20% after I sold, *ouch*

- increase in trading activities as I look for new ideas for the next few years.

Gainers and losers

The following tables show the top gainers and losers for this year thus far. The list should remain pretty much the same by end of the year.

I am glad that 7 out of my 10 core holdings have returned more than 10% thus far this year. Even with the divestment of Best World and Micro-Mechanics, the ratio of 5 out of 8 still looks good.

Looking at the table, it seems that I have a tendency to divest my non-core holding once it has done well. This is something which I wasn't aware of before this post. It will be something that I will take note of in future. Instead of divesting the counter after a strong performance, another option would be for me to spend more effort in understanding the counter and determine the possibility of turing it that into a core holding.

Punting on counters based on minimal information and uncertain business outlook continues to be a game of chance. Fu Yu went 10% up but Oceanus and Innotek went the other way. Not in a hurry to divest Oceanus and Innotek yet as amount put in was minimal, especially for Oceanus. Also, am still feeling positive of a possible turnaround next year or the year after next.

The table also highlighted the strong performance of my three counters in my CPF portfolio which returned 16% thus far. If this continues for the rest of the year, it will be the 9th consecutive year that my CPF portfolio beats STI ETF.

The following tables show the top gainers and losers for this year thus far. The list should remain pretty much the same by end of the year.

I am glad that 7 out of my 10 core holdings have returned more than 10% thus far this year. Even with the divestment of Best World and Micro-Mechanics, the ratio of 5 out of 8 still looks good.

Looking at the table, it seems that I have a tendency to divest my non-core holding once it has done well. This is something which I wasn't aware of before this post. It will be something that I will take note of in future. Instead of divesting the counter after a strong performance, another option would be for me to spend more effort in understanding the counter and determine the possibility of turing it that into a core holding.

Punting on counters based on minimal information and uncertain business outlook continues to be a game of chance. Fu Yu went 10% up but Oceanus and Innotek went the other way. Not in a hurry to divest Oceanus and Innotek yet as amount put in was minimal, especially for Oceanus. Also, am still feeling positive of a possible turnaround next year or the year after next.

The table also highlighted the strong performance of my three counters in my CPF portfolio which returned 16% thus far. If this continues for the rest of the year, it will be the 9th consecutive year that my CPF portfolio beats STI ETF.

Allocation

Dividend vs Growth

With the divestment of two core holdings and exploration of the US market, the allocation looked quite different from the the first half of the year. Cash stands at a high of 15%. Dividend yield of portfolio based on cost is at a low of 3.4%.

With the divestment of two core holdings and exploration of the US market, the allocation looked quite different from the the first half of the year. Cash stands at a high of 15%. Dividend yield of portfolio based on cost is at a low of 3.4%.

Planned

|

Actual

| |

Dividend

|

~ 60%

|

55%

|

REIT/ Business Trust

|

<= 30%

|

25%

|

Growth

|

~ 40%

|

30%

|

Punt

|

<=10%

|

3%

|

Cash

|

0%

|

15%

|

Singapore vs US

Being new to US market, I decided to allocated at most 15% of my fund to it till end of 2018. Currently, it stands at about 12% with 4% invested and 8% in cash.

Action

For the month of September, I have sold

- Dairy Farm at US$8.03 for a gain of 5.0%.

- Singapore O&G at $0.49 for a gain of 2.1%.

- mm2 Asia at $0.49 for a gain of 1.9%.

- Mapletree GCC Trust at $1.15 for a gain of 4.9%.

I have bought the first 3 in August due to their steep drop. Decided to divest them for a quick profit and re-invest them in other counters which I am more familiar with. As for Mapletree GCC, bought it last month with an incorrect understanding of the location of its HK property. Got lucky with it, so decided to take profit.

On the US Market, I have also sold

Dug into the numbers and checked the PE and growth rate of my US counters. The current PE for the first 3 stocks are all much higher than its historical average and PEG are all above 2. Hence, decided to divest them. As for Chiptole, there is currently too much uncertainty and so decided to stay away from it for the moment.On the US Market, I have also sold

- Cognex at US$114.45 for a gain of 3.4%.

- Mastercard at US$140.23 for a gain of 6.1%.

- Priceline at US$1840.60 resulting in a loss of 5.1%.

- Chipotle at US$307 resulting in a loss of 13.4%.

I have added

- more Straco at $0.87. Continue to like its cash generating business. This article by the "Rock" in NextInsight provides a good reading.

- more Hong Kong Land at US$7.28. Same reason as initial purchase in August. Cheap P/B and good results.

- more 800 Super at $1.085 as it continued to trend lower after its announcement of its Q4 results. Two quarters of weaker performances but it has continued to increase its dividend. Looking for a better performance in 2018.

- more Japan Food at $0.435. Same reason as initial purchase - consistent dividend.

- iFAST at $0.87. Its price has slid from its high after announcing a strong 1H results. While its China business will take some time to break even, its other countries performance is growing very well.

- Hock Lian Seng at $0.445. High visibility due to strong record book. If the company is able to maintain its dividend of 2.5 cents, then the yield is about 5.6%.

- ComfortDelgro at $1.995. Bought a tiny stake as I felt that it is oversold. While Taxi business is under great pressure, rail and bus are still doing well. Due to a sudden turn in its share price, I sold it today at $2.08 for a small gain of 2.8%.

Core holdings

Core holdings are counters which I am more familiar with. These are counters which I am more confident of and have a more substantial holding (at least 5% of portfolio); hence I am more likely to hold them for a longer period of time.

The current average holding period is about 2.4 years, as compared to 0.5 years for the remaining holding.

Divestment of Best World and Micro-Mechanics and purchase of VICOM has resulted in partial change of core holdings. These 8 (out of 26) holdings make up 53% of my outlay cost.

The current average holding period is about 2.4 years, as compared to 0.5 years for the remaining holding.

Divestment of Best World and Micro-Mechanics and purchase of VICOM has resulted in partial change of core holdings. These 8 (out of 26) holdings make up 53% of my outlay cost.

- Food Empire (9%) @ $0.46

- Raffles Medical (8%) @ $1.41

- Straco (8%) @ $0.85

- Parkwaylife REIT (6%) @ $2.32

- Valuetronics (6%) @ $0.54

- Fraser Centrepoint Trust (6%) @ $2.03

- VICOM (5%) @ $5.75

- Starhill Global (5%) @ $0.70

Looking Ahead

For the remaining quarter, I am looking forward to dividend from various REITs, 800 Super, RMG, SingTel, UMS, iFast and Japan Food. I am also hopeful of good quarterly result from Food Empire, Straco and Valuetronics which might have a positive impact on their prices. Raffles Medical Group should report another quarter of muted performance.

Barring any unforeseen circumstances, return for the year should be above 35%. With some luck, it might breach the 40% mark.